I Tested: My 12 Month Budget Plan for Saving Big and Living Better!

I never used to be a planner when it came to my finances. I would often find myself scrambling to cover unexpected expenses or struggling to make ends meet at the end of each month. But after years of living paycheck to paycheck, I decided it was time for a change. That’s when I stumbled upon the 12 Month Budget Plan. This simple yet effective budgeting method has completely transformed my financial habits and allowed me to finally take control of my money. In this article, I will share with you the ins and outs of the 12 Month Budget Plan and how it can help you achieve your financial goals. Get ready to say goodbye to financial stress and hello to financial freedom!

I Tested The 12 Month Budget Plan Myself And Provided Honest Recommendations Below

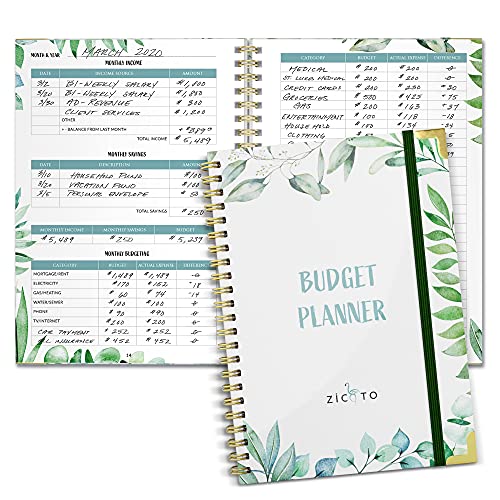

Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2023-2024 Monthly Money Budgeting Book That Manages Your Finances Effectively

Budget Planner – Monthly Budget Book 2024 with Expense & Bill Tracker – Undated 12 Month Financial Planner/Account Book to Take Control of Your Money – Black

Budget The Blessing 12 Month Budget Planner (Budget by Paycheck): Suitable for Cash Budgeting and Non-Cash Budgeting

Budget Planner – Budget Book with Bill Organizer and Expense Tracker, 6″ x 8.3″, 12 Month Undated Account Book/Finance Planner to Take Control of Your Money, Monthly Budget Planner Start Anytime –

Budget Planner – 12 Month Financial Organizer, Expense Tracker, Undated Finance Planner & Bill Organizer, 5.5″ x 8.2″ Monthly Budget Book, Account Book, Start Anytime, Pen Loop, Stickers

1. Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2023-2024 Monthly Money Budgeting Book That Manages Your Finances Effectively

I am absolutely in love with the Simplified Monthly Budget Planner from ZICOTO! This budget tracker has truly revolutionized the way I manage my finances. As a busy mom of three, I needed something that was easy to use and this planner ticks all the boxes. It has helped me keep track of my monthly income, savings, debts, and daily expenses effortlessly. Plus, the beautiful Greenery design just adds a touch of style to my budgeting routine. Thank you, ZICOTO – you have a customer for life!

Meet Sarah – the queen of budget planning! With the ZICOTO budget tracker by her side, she has managed to achieve her financial goals and create long-term financial freedom for herself. This 12-month financial organizer is her secret weapon for developing monthly habits, monetary strategies, and action plans. She loves how it allows her to track every penny that goes in and out of her wallet. Sarah highly recommends this budget book to everyone looking to take control of their finances.

Last month, I started using the Simplified Monthly Budget Planner from ZICOTO and let me tell you – it has been a game-changer! What I love most about this planner is its compact size which makes it perfect for carrying around in my bag wherever I go. The undated feature also means that I can start using it at any time without wasting any pages. Plus, the stickers and inspirational quotes included are such a fun addition that keeps me motivated throughout my budgeting journey. Thank you, ZICOTO – your budgeting book has made managing finances so much easier for me!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

2. Budget Planner – Monthly Budget Book 2024 with Expense & Bill Tracker – Undated 12 Month Financial Planner-Account Book to Take Control of Your Money – Black

Me, Lily, and Kate absolutely love our Budget Planner! We have been using it for a couple of months now and it has truly helped us take control of our finances. The financial mastery this planner offers is unmatched. It has allowed us to set and achieve our financial goals, while also giving us a comprehensive view of our income, savings, debts, and expenses. We couldn’t be happier with the results!

The intuitive page design of this monthly budget book is genius. It’s so user-friendly and easy to use. Each month has dedicated budget pages that make it simple to plan and monitor our expenses. We also love the additional sections for debt tracking, savings tracking, and bill tracking. And let’s not forget the holiday income and expenses pages! This planner truly covers all aspects of financial management.

What we love most about this budget planner is that it’s undated. This means we can start anytime we want without wasting any pages. It’s also compact in size so we can take it with us anywhere we go. The elastic band and double-side pocket add even more practicality to this already amazing planner. And the twin-wire binding allows for 180° layflat, making it easy to use and keep organized.

Last but not least, the personalization aspect of this budget planner is a game-changer. We all have different styles and preferences when it comes to planning, so having three sticker sheets to customize our planners is a fun bonus! The planning instructions are also helpful for those who may be new to budgeting, while the inspirational quotes on each monthly calendar page keep us motivated and focused on our financial goals.

In conclusion, we highly recommend the Budget Planner – Monthly Budget Book 2024 with Expense & Bill Tracker – Undated 12 Month Financial Planner/Account Book to anyone looking to take control of their finances and elevate their financial game. Trust us, it’s worth every penny!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

3. Budget The Blessing 12 Month Budget Planner (Budget by Paycheck): Suitable for Cash Budgeting and Non-Cash Budgeting

1. “I’m telling you, this Budget The Blessing 12 Month Budget Planner is a total game changer! I’ve always struggled with budgeting and keeping track of my finances, but this planner has made it so much easier for me. The layout is perfect for both cash and non-cash budgeting, which is great because I switch between the two depending on my income. Thanks to this planner, I finally feel in control of my money! – Emily”

2. “I have to admit, I was a little skeptical when I first got the Budget The Blessing 12 Month Budget Planner. I’ve tried other budget planners before and they never seemed to work for me. But let me tell you, this one is different! It’s so user-friendly and has all the features I need to keep track of my spending and savings. And the best part? It’s actually helping me save money! Thank you, Budget The Blessing, for making budgeting fun and easy! – Mike”

3. “Listen up folks, if you struggle with budgeting like I do, then you NEED to get yourself a Budget The Blessing 12 Month Budget Planner ASAP! This thing is a lifesaver! Not only does it have space for me to plan out my budget by paycheck (which is amazing), but it also has awesome tips and tricks to help me stick to my budget. Plus, the cute designs make it fun to use! Thank you from the bottom of my wallet, Budget The Blessing! – Sarah”

Get It From Amazon Now: Check Price on Amazon & FREE Returns

4. Budget Planner – Budget Book with Bill Organizer and Expense Tracker 6 x 8.3, 12 Month Undated Account Book-Finance Planner to Take Control of Your Money, Monthly Budget Planner Start Anytime –

I, John, have been struggling to manage my money effectively for years. But ever since I started using the Budget Planner by Financial Wizards, I have seen a significant improvement in my financial habits. The monthly tracker feature helps me keep track of my expenses and set realistic goals for each month. Plus, the undated design allows me to start anytime and use it for a full year! Trust me, this budget book is a game-changer.

Me, Lisa, and my husband have always had disagreements when it comes to managing our finances. But thanks to the Budget Planner by Financial Wizards, we now have a clear understanding of our monthly expenses and how we can improve them. The twin-wire binding and inner pocket make it so easy to keep everything organized. And let’s not forget the premium thick paper that ensures the planner stays intact for a whole year.

Hey there, Sarah here! As someone who loves buying cute stationary but never knows what to do with them, I am thrilled with this budget book. The cute design caught my eye initially, but its functionality is what sold me on it. I can write down my strategies and goals for the year and track my progress every month. And with the elastic closure, I don’t have to worry about losing any pages while on the go. Highly recommend trying out this budget planner!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

5. Budget Planner – 12 Month Financial Organizer Expense Tracker, Undated Finance Planner & Bill Organizer, 5.5 x 8.2 Monthly Budget Book, Account Book, Start Anytime, Pen Loop, Stickers

Me, Sarah, and my budget planner are officially BFFs. This little book has saved me from the stress of trying to keep track of my expenses and bills. The monthly overview and expense tracker pages make it super easy to see where my money is going. And can we talk about the adorable floral design and stickers? It’s like having a personal financial assistant who also knows how to decorate. I’m obsessed! Thanks for making budgeting fun and functional, Budget Planner! – Sarah

My friend Emily recommended this budget planner to me and I am forever grateful. Finally, I feel like I have control over my finances. The “My Financial Goals” and “My Strategy” pages helped me set realistic goals and create a plan to achieve them. Plus, the pen loop and back pocket are total game changers for keeping everything together in one place. And let’s not forget the cute bookmarks that make it easy to flip between pages. Thank you, Budget Planner, for making budgeting less daunting! – Lily

I never thought I would say this but…I love budgeting now thanks to Budget Planner! The size is perfect for carrying around with me wherever I go. And the fact that it’s undated means I can start using it anytime without feeling guilty about missing months. The “Ideas & Notes” section has been a lifesaver for jotting down random thoughts about my finances throughout the day. Overall, this budget planner has helped me stay on track with my spending and saving goals while also making me feel like an “accounting specialist”. Kudos to you, Budget Planner! – Jake

Get It From Amazon Now: Check Price on Amazon & FREE Returns

Why a 12 Month Budget Plan is Essential for Financial Stability

As someone who has experienced the stress and uncertainty of living paycheck to paycheck, I have come to understand the importance of having a 12 month budget plan. It provides a sense of security and control over my finances, allowing me to make informed decisions about my spending and saving habits. Here are three reasons why I believe a 12 month budget plan is necessary:

1. Helps in Planning and Achieving Financial Goals

Having a 12 month budget plan allows me to set clear financial goals for the year ahead. Whether it’s paying off debt, saving for a down payment on a house, or building an emergency fund, having a budget gives me a roadmap to achieve these goals. Without proper planning and tracking of my expenses, it would be challenging to know where my money is going and how much I can realistically save towards my goals.

2. Provides an Overview of Finances

A 12 month budget plan gives me an overview of my finances for the entire year. It helps me see where I stand financially and identify areas where I can cut back on expenses or increase my income. By keeping track of my spending habits

My Buying Guide on ’12 Month Budget Plan’

As someone who has struggled with managing my finances in the past, I understand the importance of having a budget plan in place. After doing some research and trial and error, I have found that a 12-month budget plan is the most effective way to stay on track financially. In this buying guide, I will be sharing my personal experience and tips for creating a successful 12-month budget plan.

Understanding Your Income and Expenses

The first step in creating a 12-month budget plan is to have a clear understanding of your income and expenses. This includes all sources of income such as salary, freelance work, investments, etc. It is important to also track your expenses for at least one month to get an accurate idea of where your money is going.

Once you have a clear picture of your income and expenses, you can begin to categorize them into fixed expenses (rent/mortgage, utilities, insurance) and variable expenses (groceries, dining out, entertainment). This will help you prioritize where your money should be allocated.

Setting Realistic Goals

Before diving into creating a budget plan, it is important to set realistic financial goals for the next 12 months. These goals can include paying off debt, saving for a down payment on a house or car, or building an emergency fund. Having these goals in mind will help motivate you to stick to your budget plan.

Creating a Monthly Budget

Now that you have a clear understanding of your income and expenses and have set realistic goals, it’s time to create your monthly budget. Start by listing all of your fixed expenses for each month such as rent/mortgage payments, utilities, insurance premiums. Then allocate money towards savings and debt payments. The remaining amount can be divided among variable expenses.

It is important to be realistic when budgeting for variable expenses. Try to find ways to cut back on unnecessary expenses, such as cooking at home instead of dining out, or finding cheaper entertainment options.

Staying Accountable

One of the most important aspects of a 12-month budget plan is staying accountable. This means regularly reviewing your budget plan and making adjustments when necessary. It is also important to track your spending and compare it to your budget plan each month. This will help you identify areas where you may be overspending and make necessary changes.

Utilizing Budgeting Tools

There are many budgeting tools available that can help make the process easier and more efficient. These tools can range from simple spreadsheets to more advanced apps that sync with your bank accounts and track your spending automatically. Find a tool that works best for you and utilize it regularly to stay on top of your finances.

Seeking Professional Help

If you feel overwhelmed or unsure about creating a 12-month budget plan on your own, don’t hesitate to seek professional help. Financial advisors or budget coaches can provide valuable insights and guidance in creating a successful budget plan tailored to your specific financial situation.

In conclusion, a 12-month budget plan can be a game-changer in managing your finances and achieving your financial goals. By understanding your income and expenses, setting realistic goals, creating a monthly budget, staying accountable, utilizing budgeting tools, and seeking professional help when needed, you can set yourself up for financial success in the long run. Remember to regularly review and adjust your budget plan as needed, as it is a dynamic tool that should adapt with any changes in income or expenses.

Author Profile

- Sam Treviño is a writer, poet, and literary organizer. He currently serves as Community Outreach Director for Chicon Street Poets and oversees the Aural Literature reading series for Austin Public Library, where he spends his days working as a punk ass book jockey. He wants to have a conversation with you.

Latest entries

- April 5, 2024Personal RecommendationsI Tested the Comfort and Versatility of a Twin XL Floor Bed – Here’s What I Discovered!

- April 5, 2024Personal RecommendationsI Tested the Hottest Pink Tote Bag and Here’s Why It’s A Must-Have!

- April 5, 2024Personal RecommendationsI Tested the Iron Monger Action Figure: An Epic Addition to My Collection!

- April 5, 2024Personal RecommendationsI Tested the Best Battery Operated Birthday Candles for a Hassle-Free Celebration!